Wealth Wednesday: Tips for Avoiding an IRS Audit

Six tips to keep in mind when filing your return.

1 / 8

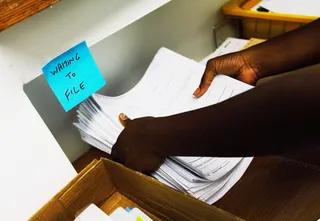

Six Tips - The Internal Revenue Service targets nearly 1.6 million individual tax returns for audits annually — or about 1.11 percent of the total number of individual returns filed in the U.S. And while the bulk of those returns involve taxpayers who report upwards of $10 million in annual income, a number of lower earners also get caught in the audit net every year.While there’s no 100 percent guaranteed way to ensure that your tax return isn’t audited, here are six good tips to keep in mind when filing your return this year. — Bridget McCrea(Photo: Melanie Stetson Freeman/The Christian Science Monitor via Getty Images)

2 / 8

Tap Into Free Tax Prep Help - If your family income is $51,000 a year or less you could be eligible for free tax preparation help. Offered by community organizations nationwide, this program allows eligible taxpayers to get their federal income taxes prepared and e-filed at no charge by an experienced tax professional. (Photo: Kansas City Star/MCT /Landov)

3 / 8

Use Tax Software - For under $50 you can buy the most current version of popular tax software TurboTax or H&R Block and use them to gather your financial data, do the calculations and even e-file your return directly from the programs. Math errors are one of several known IRS audit triggers, according to H&R Block, which says small math errors are usually fixed and forgiven, but claiming the wrong deductions and credits, filing under the wrong status and stating the wrong income are major no-nos to avoid. (Photo: Tim Boyle/Getty Images)

4 / 8

Double Check Those Home Office Expenses - Home office deductions have historically been a major audit target for the IRS, which wants to make sure your “business” and “hobby” expenses aren’t being co-mingled. Tread carefully with your home office deductions, keep good receipts and records, and be sure to only write off the portion of your home and expenses that support your for-profit entity (defined by the IRS as making a profit for at least three of the last five tax years). (Photo: GettyImages)

5 / 8

Double-Check Oversize Deductions - Keep an eye on deductions that look too big for your income level. If, for example, you make $30,000 a year and claim to donate half that amount to a local charity, the IRS’ red flag is sure to be raised. Put simply, the bigger the deduction, the higher the odds of a possible audit. Discuss any legitimate, large claims with your accountant or tax preparer and be able to back up all deductions with receipts before hitting send on that return. (Photo: GettyImages)

ADVERTISEMENT

6 / 8

Report All Income Accurately - Come tax time, it’s easy to forget about that $1,000 side work project you completed last summer or the $1,500 in casino winnings that you took home from Las Vegas. These additional earnings must be reported on top of any W-2 wages and are typically reported directly to the IRS via the 1099-MISC form. You should also get a copy of this form ahead of tax day from every payer, but even if you don’t you will be required to report the income on your tax return. (Photo: Courtesy Internal Revenue Service)

7 / 8

Stay On the Up-and-Up - One of the best ways to avoid an IRS audit is by filing truthful tax returns. The IRS uses a system of checks and balances to verify all returns and can pick up fairly quickly on any discrepancies. In the case of an error or even an audit, the taxpayer who has reported truthful information and who has the records and receipts to back up that data will be the one who comes through the audit unscathed. (Photo: Chris Hondros/Getty Images)

Photo By Photo: Chris Hondros/Getty Images